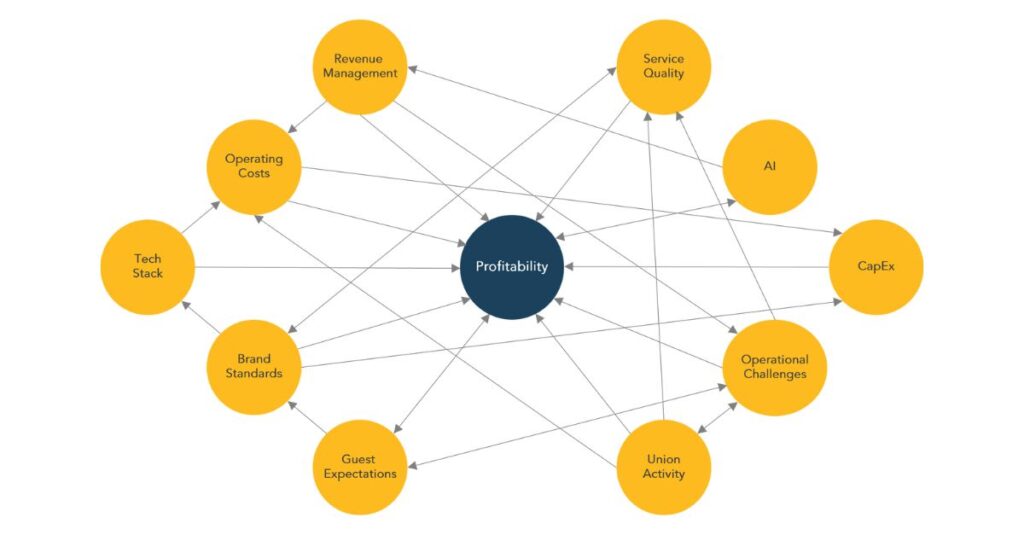

Over the past few years, hotel investors have taken significant strides in reimagining “asset management” by adopting a more holistic approach beyond traditional financial oversight, driven by rising wages, escalating operational costs, misaligned management company partnerships, and competitive and technological pressures.

Their actions reflect an evolution in asset management that empowers ownership groups to exert greater control over their properties’ performance, ensuing relevance to guests, employees, and communities, while also meeting profitability and underwriting targets.

Interestingly, owners have taken varied approaches in recent years. Some are internalizing previously outsourced functions by building new in-house teams, while others have created fully owned platform companies, both approaches leveraging specialized expertise and an ownership mindset across critical areas such as development, revenue management, expense control, and F&B. Ownership groups are also aligning their asset management teams’ incentives with internal objectives and rewarding those responsible for driving profitability and growth.

For instance, Blackstone has built robust asset management capabilities through its platform company BRE Hotels & Resorts that focus on revenue management and distribution while driving operational efficiencies and profitability across both select-service and full-service portfolios. Meanwhile, Trinity Investments as vertically-integrated firm specializing in hospitality investments, has rebranded its Asset Management function as Strategic Operations, signaling its differentiation in actively creating value through redevelopment, repositioning, new revenue streams, and improved operational efficiencies. This includes bringing in specialized team members, such as operations and food and beverage experts, to optimize performance across the portfolio on their internal team.

Similarly, firms like BDT & MSD Partners have broadened their hotel capabilities by integrating development and placemaking expertise in-house, enabling them to create multi-faceted hotel and residential products that serve not only as accommodations but also as vibrant community hubs. A prime example is The Boca Raton, where BDT & MSD developed a beach club and a members-only club, connecting the hotel to the Boca Raton community and establishing it as a popular local destination.

EOS Investors has taken a different approach by building its own management company to gain more direct control over its independent hotel properties, allowing for a quicker responses to market shifts and guests demands. While they briefly considered managing external properties to achieve economies of scale, they ultimately chose to focus on their own portfolio, prioritizing growth and operational excellence within their existing assets.

Furthermore, in recent months, amid rising costs and GOP contractions, despite strong RevPAR growth, ownership groups have increasingly turned their attention to expense reduction and leveraging economies of scale across their portfolios. For example, investors like KSL Capital Partners has consolidated its two platform companies, Mission Hill Hospitality and KSL Resorts, under one umbrella to streamline operations and enhance efficiency. Additionally, to scale its hospitality investments up or down in response to market conditions and portfolio needs, KSL leverages its ownership of Davidson Hotels, which manages both third-party properties and KSL’s own assets, providing management expertise and enhanced operational oversight.

As the hospitality industry continues to evolve, operation-driven approaches to ownership and asset management will be essential to achieving success in an increasingly competitive and complex market. Embracing creative and adaptive strategies can help safeguard investments and better position ownership groups for continued success in a rapidly changing landscape. The impact of asset management now extends far beyond the initial acquisition, with strategic decisions around risk assessment, operational efficiency, and resource allocation playing a critical role in value creation and returns, equal to or even surpassing the importance of the acquisition itself.