The adage “money makes the world go round” has never been more relevant to businesses than it is today. The perpetual demand for capital has led to both the formalization and the elevation of the capital raising role. It is now regarded as both a mission-critical role and a strategic leadership role in many firms. Traditionally, firms viewed deal-making as their core business, believing that a strong track record alone was sufficient for long-term success. Other roles, especially those outside of investments, were seen as mere necessities to support deal-making activities. However, as the fund management landscape has evolved to become more institutional and competitive, the importance of capital raising has increasingly been recognized as central to business success. The rise and dominance of AUM gatherers and the growing pressure to achieve “escape velocity” have underscored the need for dedicated capital raising professionals. These individuals have rapidly ascended to strategic leadership roles, often rivaling or even surpassing investment teams in importance.

Today, investors have higher expectations , more options , and face increased scrutiny to meet or exceed return expectations. While investors consider a range of managers for allocation, the comfortable default is often to re-up with existing, trusted managers. In this macro environment, it is even challenging for the super-scaled businesses to get an allocation from existing investors. This dynamic begs the question of how smaller and mid size fund managers can survive. The fund management industry has matured to the point where traditional, sharp-shooting deal making is no longer sufficient. Track records no longer speak for themselves. Instead, fund managers must establish a conduit for strategically approaching investors, communicating their differentiated investment strategies, and creating a feedback loop for product development to ensure investors remain engaged with the fund manager’s ecosystem. This conduit comes in the form of dedicated capital raisers and an entire support infrastructure, including people, systems and processes. This shift has resulted in the formalization of the capital raising role. Fund managers can no longer rely on their founders and CEOs to haphazardly approach various LPs, nor can they tap deal team members to pinch hit in investor meetings. This ecosystem requires a systematic, relationship-oriented approach for accessing the capital that is the lifeblood of the firm. Consequently, there has been an insatiable demand for professionals who fill these roles.

How Insatiable is the Demand?

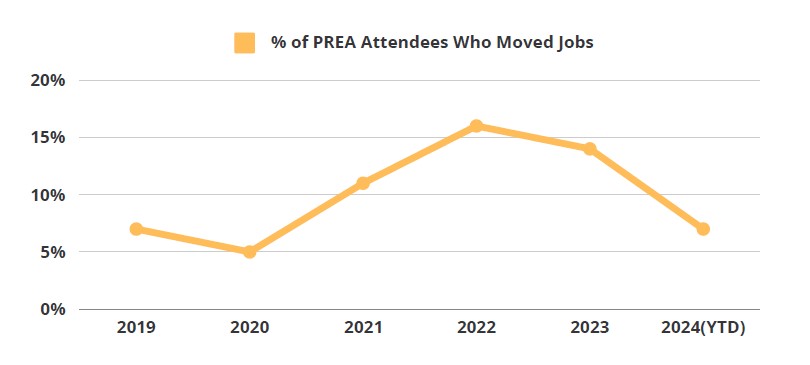

> 60%* of attendees of the PREA conference have changed jobs at least once since 2019. When including other high-profile moves tracked by Highridge Search, this figure rises to approximately 70%.** While the COVID-era may have accelerated some of this movement, career transitions have continued to escalate even as we settle into a “new” sense of normal. >30% of professionals have moved since the start of 2023.*

*The statistic regarding PREA attendees is based on the 2024 Spring Attendee list and pertains specifically to professionals focused on capital raising and capital markets. Portfolio managers and investment leaders who attended but do not occupy dedicated capital-raising roles were excluded from this calculation. While the PREA list is comprehensive, it may not capture every individual, as some are unable to attend annually and others do not register. Highridge Search tracks significant talent movements in the industry, and high-profile moves were included based on ongoing tracking of the sector.

Capital raisers are now revered as pivotal to business strategy. While Founders/CEOs and investment teams previously handled capital raising tasks intermittently, the evolving competitive landscape and sophistication of LPs have necessitated dedicated teams and resources. When businesses add the function, they look to these hires for strategic guidance and, when done right, it requires a rewiring of how organizations operate. We often refer to capital raising as a “glue seat” as these professionals sit at the nexus of many internal business lines. The success of these hires, and subsequent team buildouts, requires a reconfiguration of how information flows both internally and externally. Meanwhile, these hires must exhibit a supreme understanding of all stakeholders’ needs and an ability to direct strategy to align interests.

It is therefore no accident that this role is often elevated to the highest levels of leadership, working hand-in-hand with the top ranks. In some cases, the traditional role of a COO or #2 is converging with the Head of Capital Formation role. Furthermore, we are beginning to see professionals be promoted to Co-Head of the entire vertical or firm, a position once reserved for those who ascended through the investment team ranks. This shift reflects the value capital raisers bring by providing critical insights into investor preferences and subsequently informing product development and strategic planning. Much like Nike transformed from a shoe manufacturer to a marketing behemoth, the essence of fund managers has shifted from deal-making to capital raising.